Amazon is looking to envision a new financial wellness product that fills an unmet need across our customer base and drives trust through engagement. Key to this effort is the early creation of POCs to fuel customer validation and be included in a business case to be presented to Amazon's board.

Goals for the initiative

- Build upon research to date to create a more comprehensive understanding of user expectations and pain points in the context of an expanding marketplace of Personal Finance Management (PFM) options

- Identify opportunities to provide differentiated value through Amazon's existing ecosystem

- Craft and validate the product concept, experience and key features with an eye towards technical delivery

- Product Designer

- User Research

- Interaction Design

- Visual design

- Prototyping & Testing

Amazon's PFM is represented in the value proposition:

Amazon's Money is an app that empowers you to gain control and confidence over your financial life, maintain healthy spending habits, and achieve your financial goals. The app gives you a consolidated and secure view of your finances, tools for tracking and managing cash flow, and support for minimising surprises around your money. Amazon Money combines advanced technology and its wealth of anonymised data with your personal goals and preferences to turn insight into action, offering you smart, practical guidance and behavioural nudging exactly when you need it. Ultimately, Amazon Money enables you to spend smarter with (Amazon and beyond), grow your savings, and plan for your future.

The App is free for everybody, allowing Amazon to prove its commitment as a trusted partner working to improve the lives of our customers, our employees, our partners and the world at large.

As we navigate the complex web of modern financial demands, it becomes increasingly evident that traditional banking and financial services often need to be improved in addressing the unique challenges faced by individuals and households. From managing expenses to saving for the future to investing wisely, many people are overwhelmed, stressed, and unsure about achieving their financial goals. This is where the notion of "Amazon Money" steps in—a visionary response to the evolving financial needs of our time.

This research endeavour sought to unravel the multifaceted reasons behind the demand for Amazon Money, examining the shifting dynamics of personal finance and the role Amazon could play in reshaping the financial wellness landscape.

- Customers research interviews

- Stakeholder interviews

- Market and competitive review

- Quantitative validation customer survey

- Customer research interviews (18 individuals)

- Stakeholder interviews

- Market and competitive review (Agency)

- Quantitative validation customer survey (surveyed 1102; 552 UK, 550 US)

The key areas we need to validate were:

- Customer needs

- Competitive intel

- Differentiation

- Right to play and benefits to Amazon

- Engagement and retention

Market research uncovered these themes pertaining to finding success in the PFM market.

To provide a value-add product, we must incorporate these 7 key product tenets:

- Be personalised and dynamic to each customer

- Keep them informed to reduce day to day anxiety

- Deepen trust in Amazon

- Provide approachable, dependable guidance

- Support ease though automations

- Create new behaviours in a 'feel good' way

- Generate unique value as Amazon

- The purpose of this story is a validation of test scenarios and narratives with customers and response to their feedback. We are largely viewing the flows and layout of this within the context of the capability being offered to the customer, and these screens capture their most expressed reactions and desires within the UI. This overarching lens should be kept in mind.

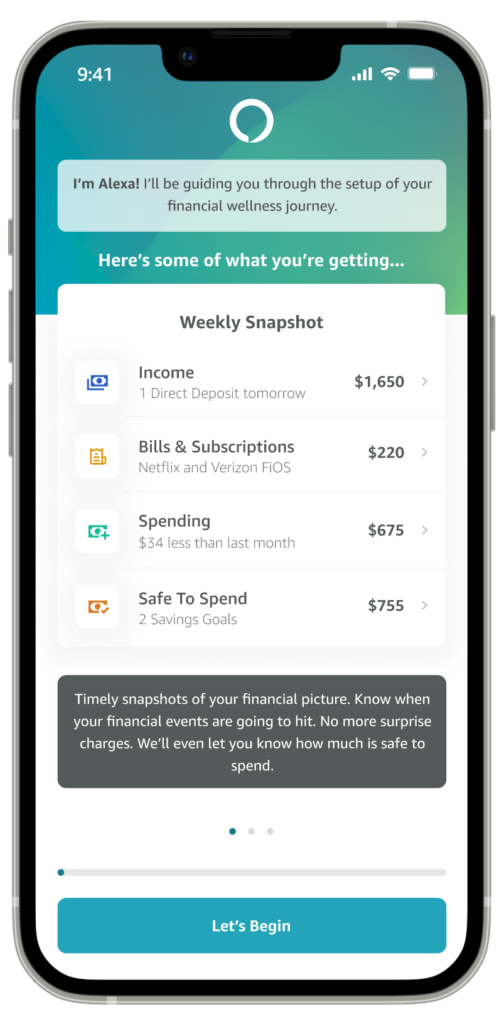

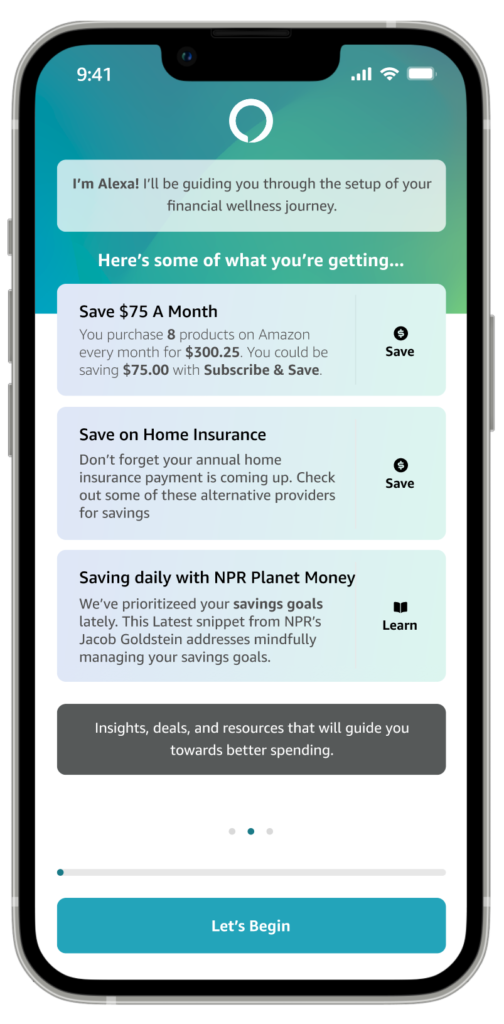

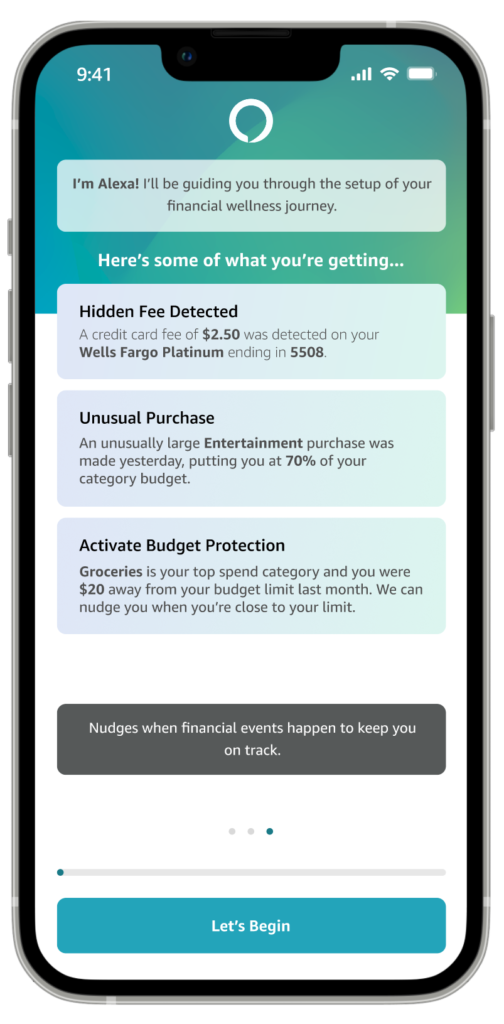

- Observing all areas of opportunity in the current PFM space was imperative. Ease of onboarding was a strongly iterated area, where it was important to utilise customer familiarity with Amazon's existing retail venues to show them components of what they would be getting with their existing customer data. From there, we provide a CTA into the experience where, through testing, we achieved successful buy-in by providing transparency around the security and a visual walkthrough of the spending, saving and insights tools that would yield the most value for their financial plans.

- Once the user is brought into the experience, significant priority is placed on creating a holistic tool that integrates into their app and spreadsheet usage, with upfront spend analysis, entry points into Amazon's competitive savings and services, intelligent automation, and relevant financial literacy resources.

The first imperative revision I took was iterating our value proposition screen from a list of what customers could expect into a visually led demonstration of some of the upfront benefits of using the app.

Across the board, users were sceptical of what they would get in exchange for sharing so much of their personal behaviours and information. This lack of clarity is often worrisome thoughts regarding Amazon and how they handle privacy.

However, when they landed on the dashboard and viewed the Insights and Weekly Spending sections, they immediately changed perspective and expressed interest in having this tool. Somehow, the criticism meant less because the visual examples of how they could save and understand their finances outweighed other concerns. The mystery around what this tool would do in the UI posed a threat, so we moved the components they were most excited about to the front so they could connect confidently.

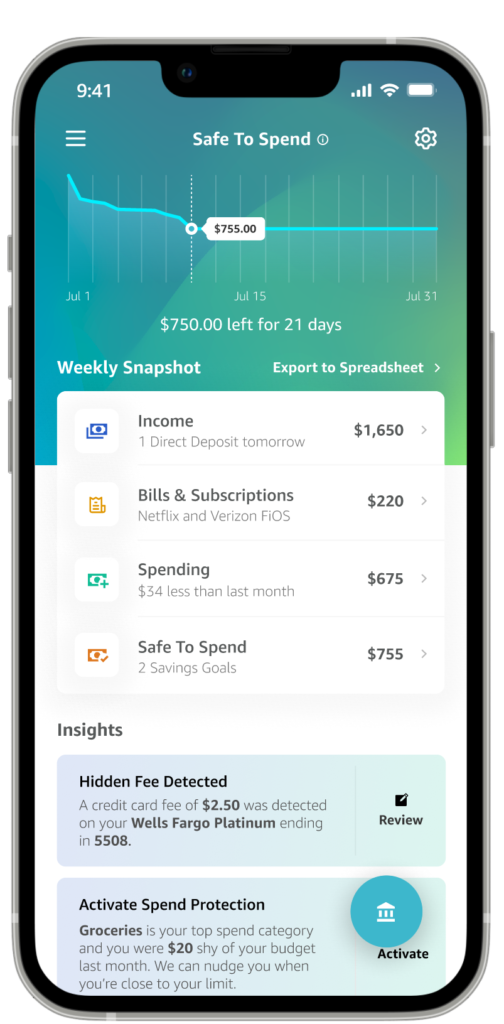

Below are three stages of the scrolling carousel showing off the weekly snapshot, insights, and alert-orientated nudges that customers responded the most positively to in testing.

Once everything is connected, we're brought to the Today View. We lead with their Safe to Spend amount, where users can plan accurately by knowing how much they can spend without surprises. It will be the cash they have readily available after routine bills and subscriptions have been taken out.

Next is the Weekly Snapshot, for the user to know when their paychecks, bills, subscriptions, and other routine financial events will hit. All of their income events that week, all of the scheduled bills and subscriptions that week, spending thus far, and available funds thus far. No more surprise charges as it makes customers aware of their spending patterns.

In the bottom right is a button for quick access to view all of their connected accounts in one place.

Midway into our testing, I removed the step-by-step tutorial explaining what each component did to see how users would respond to figuring it out on their own, and it turned out that they didn't need their hand held around it, which was interesting. The layout of the weekly snapshot helped contextualise what safe to spend meant as long as we kept the language consistent, so I made some revisions to ensure that was the case. And again, this was where sceptical users changed their minds about the utility of this tool.

As far as UI is concerned, I made two significant additions. On one end, I added an Export to Spreadsheet option, a highly communicated desire from the beginning of research that customers responded very positively about in testing. I also created a dedicated, categorised insights screen for users to view all their insights in one place.

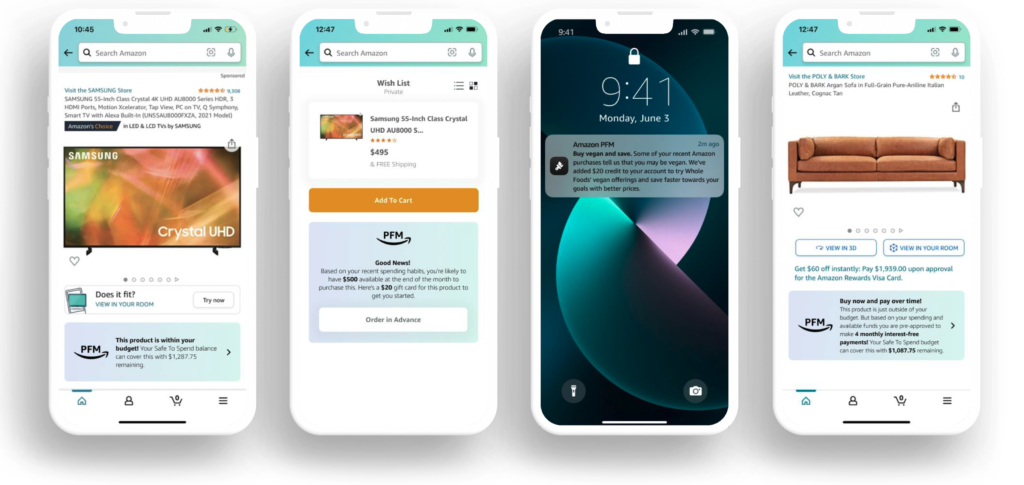

Integrated into the Amazon retail experience, I have established the budget assistance tool letting customers know what they can afford, their wish list encouragement that provides rewards for saving toward their goals, personalised nudges to try Whole Foods based on what we know about them, such as if they have been purchasing vegan and haven't engaged with Whole Foods' wide vegan selection. Before testing, I also added a new Buy Now Pay Later component to the budget assistance, letting the customer know, "Hey, you can buy this now and pay later over time. This product is just outside your budget, but based on your spending and available funds, you are pre-approved to make 4 monthly interest-free payments."

- Lead with Amazon branding but visually differentiate from retail.

- Demonstrate the value of the solution and expected benefits - from various points of entry through onboarding.

- Reinforce safety throughout the experience.

- Savings opportunities will hook customers, but insights will keep them coming back. Investing in actionable, relevant insights, suggestions, and offers will have the most significant impact on retention and flywheel acceleration.

- Consider partnering with a 3rd party content provider to ingest financial literacy content surfaced through insights. Customers may more positively receive an established, reputable financial or educational institution or impartial 3rd party. Consider curated courses or course snippets with interactive elements and financial incentives in later phases.

- Consider further exploration and testing to address the household scenario given the known behaviours around shared finances and Prime customers sharing accounts with friends/family.

- Enable select exports to spreadsheet formats for power planners

Regrettably, for seasoned product designers who have weathered the storms of corporate decision-making, such setbacks are an all-too-familiar aspect of the professional landscape. These experiences, while frustrating, serve as crucial learning opportunities and tests of resilience. They underscore the importance of not only creating innovative products but also developing the skills to effectively communicate their value to decision-makers who may not share the same visionary perspective.

Our mission as product designers extends far beyond the conception and development of novel ideas. We are tasked with nurturing and championing these innovations through various stages of scrutiny and evaluation. This process often involves:

- Conducting thorough market research to substantiate the product's potential

- Developing compelling prototypes or proofs of concept

- Crafting persuasive presentations that translate technical features into business value

- Building coalitions of supporters across different departments

Anticipating and addressing potential objections or concerns

Ultimately, our role is to serve as the bridge between cutting-edge innovation and pragmatic business strategy. By persistently advocating for forward-thinking solutions, we aim to influence and shape the decision-making process at the highest levels of the organisation. This advocacy is not just a role but a responsibility that often requires a delicate balance of patience, persistence, and adaptability.

While the immediate outcome may be disappointing, it's crucial to maintain perspective. Each seeming setback is a stepping stone towards future successes as we refine our approach and gradually shift the organisational culture towards greater receptivity to innovation. In doing so, we play a vital role in ensuring the long-term viability and competitiveness of our organisations in an ever-evolving marketplace.